west virginia motor fuel tax rates 2023 42+ state tax commissioner of west virginia sales listing form png

Driving down the highway or cruising around town, we all rely on our vehicles to get us where we need to go. But have you ever stopped to think about the cost of that convenience, specifically in terms of fuel taxes? Each state has its own motor fuel excise tax rate, which helps fund road construction and maintenance. Here’s a breakdown of the current rates across the country, along with a glimpse into the bond requirements for those working in the West Virginia motor fuel industry. Alabama: 18 cents per gallon Alaska: 8 cents per gallon Arizona: 19 cents per gallon Arkansas: 22.5 cents per gallon California: 42 cents per gallon Colorado: 22 cents per gallon Connecticut: 25 cents per gallon Delaware: 23 cents per gallon Florida: 8 cents per gallon Georgia: 28.7 cents per gallon Hawaii: 16 cents per gallon Idaho: 33 cents per gallon Illinois: 38 cents per gallon Indiana: 42.9 cents per gallon Iowa: 30.5 cents per gallon Kansas: 24 cents per gallon Kentucky: 26 cents per gallon Louisiana: 20 cents per gallon Maine: 30 cents per gallon Maryland: 36.8 cents per gallon Massachusetts: 26.54 cents per gallon Michigan: 26.3 cents per gallon Minnesota: 28.6 cents per gallon Mississippi: 18.79 cents per gallon Missouri: 17 cents per gallon Montana: 32.25 cents per gallon Nebraska: 28.9 cents per gallon Nevada: 33 cents per gallon New Hampshire: 23 cents per gallon New Jersey: 41.4 cents per gallon New Mexico: 17 cents per gallon New York: 45.97 cents per gallon North Carolina: 36.2 cents per gallon North Dakota: 23 cents per gallon Ohio: 38.5 cents per gallon Oklahoma: 19 cents per gallon Oregon: 36 cents per gallon Pennsylvania: 58.7 cents per gallon Rhode Island: 34 cents per gallon South Carolina: 20 cents per gallon South Dakota: 30 cents per gallon Tennessee: 27.4 cents per gallon Texas: 20 cents per gallon Utah: 30 cents per gallon Vermont: 32 cents per gallon Virginia: 16.2 cents per gallon Washington: 49.4 cents per gallon West Virginia: 35.7 cents per gallon Wisconsin: 32.9 cents per gallon Wyoming: 24 cents per gallon Whew, that’s a lot of numbers to digest! But it’s important information to have, especially if you’re working in the motor fuel industry in West Virginia. In order to operate in this field, you’ll need to obtain a bond from a surety company. This bond provides a safety net of sorts, ensuring that you’ll follow all applicable laws and regulations related to the sale and distribution of motor fuel. It also helps protect consumers from any fraudulent or deceptive practices on your part. So, if you’re thinking about joining the motor fuel industry in West Virginia, make sure you take the necessary steps to obtain your bond. And no matter where you’re located, remember that a portion of every gallon of gas you pump is going towards keeping our roads safe and well-maintained. Thanks for doing your part in supporting our communities!  saleposter.blogspot.com

saleposter.blogspot.com  www.wfmz.com

www.wfmz.com  transportationinvestment.org

transportationinvestment.org  www.suretybonds.com

www.suretybonds.com  wvmetronews.com

wvmetronews.com

If you are looking for 42+ State Tax Commissioner Of West Virginia Sales Listing Form PNG you've visit to the right place. We have 5 Pics about 42+ State Tax Commissioner Of West Virginia Sales Listing Form PNG like Bond Required for West Virginia Motor Fuel Industry, 42+ State Tax Commissioner Of West Virginia Sales Listing Form PNG and also States with the highest gas tax | Entertainment News | wfmz.com. Here you go:

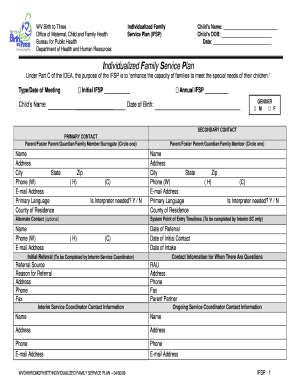

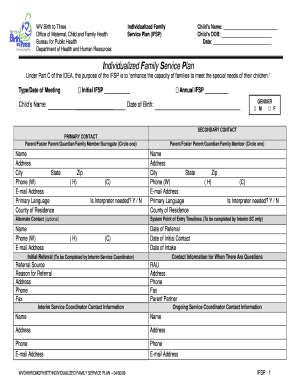

42+ State Tax Commissioner Of West Virginia Sales Listing Form PNG

saleposter.blogspot.com

saleposter.blogspot.com commissioner

States With The Highest Gas Tax | Entertainment News | Wfmz.com

www.wfmz.com

www.wfmz.com tax wfmz gasoline cents gallon

State Motor Fuel Excise Taxes | Transportation Investment Advocacy Center

state gas taxes tax map excise fuel motor pdf rates

Bond Required For West Virginia Motor Fuel Industry

www.suretybonds.com

www.suretybonds.com fuel motor bond virginia west required industry professionals

West Virginia Fuel Tax Drops On New Year's, But Is It Cause To

wvmetronews.com

wvmetronews.com cause metronews wvmetronews trended downward

State motor fuel excise taxes. Tax wfmz gasoline cents gallon. States with the highest gas tax

Posting Komentar untuk "west virginia motor fuel tax rates 2023 42+ state tax commissioner of west virginia sales listing form png"