virginia tax rates 2023 Virginia state tax tables 2023

It’s tax season again, and if you’re living in Virginia, you must’ve already received your Virginia State Income Tax Form. It can be a bit overwhelming to fill out all those numbers and codes, but fear not! We’ve got your back with some helpful tips and tricks to make your life easier.

Virginia Tax Rates

First, let’s take a look at the Virginia Tax Rates. These rates apply to all types of income, including wages, salaries, and tips. For single individuals, the tax rate starts at 2% of your taxable income up to $3,000 and gradually increases to 5.75% once your taxable income reaches $17,000 or more. For married individuals filing jointly, the tax rates are slightly lower, starting at 2% for taxable income up to $6,000 and gradually increasing to 5.75% for taxable income of $34,000 or higher.

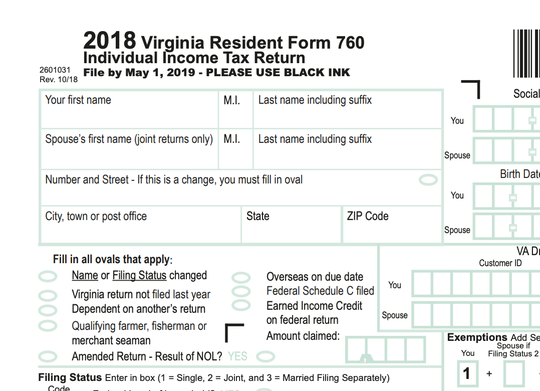

Filling out the Virginia State Income Tax Form

Now that you have an idea of the Virginia Tax Rates, let’s move on to filling out the Virginia State Income Tax Form. The form consists of several sections, including:

- Personal Information

- Filing Status

- Exemptions

- Income

- Deductions

- Tax Liability

- Credits

Make sure to read each section thoroughly before filling out the respective boxes. Also, be sure to have your W-2 and other relevant tax documents handy, as you will need to input the information from there.

Most Common Mistakes and How to Avoid Them

Lastly, let’s discuss some common mistakes that people make when filling out their Virginia State Income Tax Form, and how to avoid them.

- Filing under the wrong status: Make sure to choose the correct filing status based on your situation (single, married filing jointly, married filing separately, or head of household).

- Mathematical errors: Double check your math and make sure all calculations are correct.

- Forgetting to sign: Don’t forget to sign and date your Virginia State Income Tax Form, as it will not be considered valid otherwise.

Following these tips, tricks and guidelines should help make the process of filing your Virginia State Income Tax Form easier and less stressful. Remember to file on time and don’t hesitate to reach out to a tax professional if you need further assistance.

Ingredients

- Patience

- Attention to detail

- W-2 and other relevant tax documents

Instructions

- Read through each section of the Virginia State Income Tax Form carefully before filling out the respective boxes.

- Make sure to have all relevant tax documents handy (W-2, etc.).

- Double check your math and ensure all calculations are correct.

- Choose the correct filing status based on your situation (single, married filing jointly, married filing separately, or head of household).

- Don’t forget to sign and date your Virginia State Income Tax Form!

Now go ahead and tackle that Virginia State Income Tax Form with ease!

If you are looking for Income Tax Calculator Fy 2021-22 : Calculate your income tax liability you've came to the right web. We have 5 Pictures about Income Tax Calculator Fy 2021-22 : Calculate your income tax liability like Virginia Tax Rates - Middle Peninsula, Virginia Tax Rates by Stephen C. Kulp, MBA · OverDrive: eBooks and also Virginia Tax Rates by Stephen C. Kulp, MBA · OverDrive: eBooks. Read more:

Income Tax Calculator Fy 2021-22 : Calculate Your Income Tax Liability

wilderoret1957.blogspot.com

wilderoret1957.blogspot.com slabs apnaplan finance calculate liability ine filing taxable nri increases imposes regime

Virginia State Tax Tables 2023 | US ICalculator™

us.icalculator.info

us.icalculator.info Shin-u-design: Virginia State Income Tax Form

shin-u-design.blogspot.com

shin-u-design.blogspot.com brackets

Virginia Tax Rates - Middle Peninsula

www.mpava.com

www.mpava.com Virginia Tax Rates By Stephen C. Kulp, MBA · OverDrive: EBooks

www.overdrive.com

www.overdrive.com tax virginia rates sample read

Virginia tax rates by stephen c. kulp, mba · overdrive: ebooks. Virginia state tax tables 2023. Shin-u-design: virginia state income tax form

Posting Komentar untuk "virginia tax rates 2023 Virginia state tax tables 2023"