tax rate in virginia 2022 Virginia tax income state taxes rates employment self rate

Looking for information on Virginia state tax withholding and tax brackets? Look no further! We have compiled all the information you need to know in order to navigate Virginia's tax system.

Virginia State Tax Withholding

When you work and earn wages in Virginia, your employer is required to withhold state tax from your paycheck. This is known as Virginia state tax withholding. The amount that is withheld depends on a number of factors, such as your income, filing status, and the number of allowances you claim on your W-4 form.

Virginia Tax Brackets

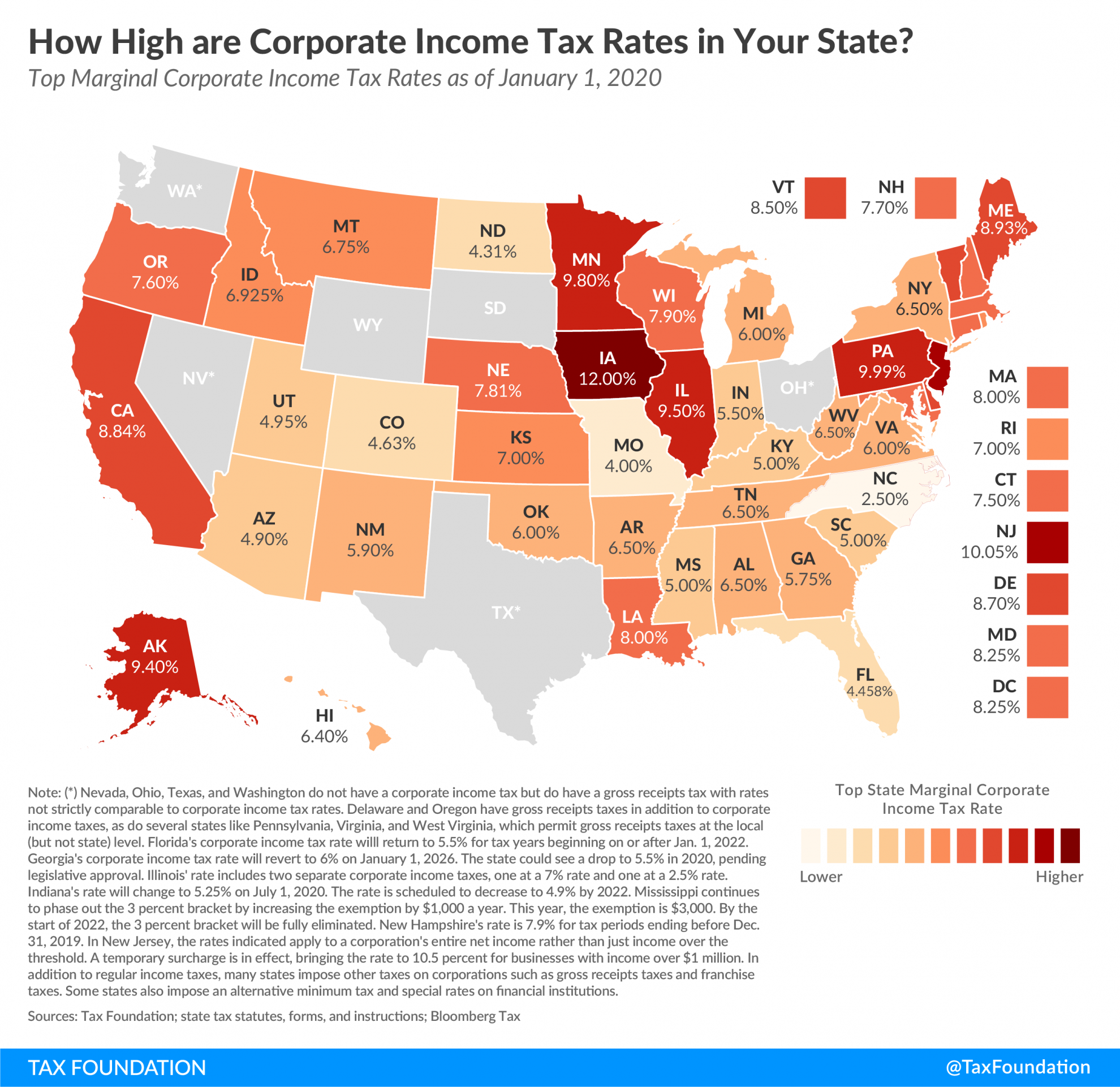

Virginia has a progressive income tax system, which means that the more you earn, the higher your tax rate will be. The state's tax brackets for 2020 are as follows:

If your taxable income falls within one of these brackets, you will owe the corresponding tax rate on that portion of your income. For example, if you are a single filer with a taxable income of $50,000, you will owe 5.75% on the first $3,000 of your income, 5.00% on the next $2,000, and so on.

Virginia State Tax Forms

In order to file your Virginia state taxes, you will need to fill out the appropriate forms. These include the Virginia Individual Income Tax Return (Form 760), the Virginia Fiduciary Income Tax Return (Form 770), and the Virginia Corporation Income Tax Return (Form 500). You can find these forms on the Virginia Department of Taxation website.

Filing Deadlines

The deadline for filing your Virginia state taxes is May 1st of each year. However, if you are unable to file by this date, you can request an extension until October 15th. Keep in mind that while an extension gives you more time to file your return, it does not give you more time to pay any taxes you owe.

Conclusion

Navigating Virginia's tax system can be overwhelming, but with the right resources and information, it can be a manageable task. Make sure to understand Virginia state tax withholding, tax brackets, and filing deadlines in order to avoid any penalties or issues when it comes time to file your taxes.

Disclaimer: The information provided in this post is for general informational purposes only and should not be construed as tax advice. Please consult with a qualified tax professional for personalized advice regarding your specific tax situation.

If you are searching about Virginia Tax Brackets 2020 you've came to the right place. We have 5 Pictures about Virginia Tax Brackets 2020 like Virginia Tax Brackets 2020, Virginia Increases Sales Tax Rate & Complication – KatzAbosch and also Virginia Increases Sales Tax Rate & Complication – KatzAbosch. Here it is:

Virginia Tax Brackets 2020

andreastorkdesign.blogspot.com

andreastorkdesign.blogspot.com brackets marginal taxable filing

What Is The Virginia Tax Rate For 2019 - TAXP

taxp.blogspot.com

taxp.blogspot.com What Is Virginia State Tax Withholding - TAXP

taxp.blogspot.com

taxp.blogspot.com withholding

Virginia Income Tax Calculator | Community Tax

www.communitytax.com

www.communitytax.com virginia tax income state taxes rates employment self rate

Virginia Increases Sales Tax Rate & Complication – KatzAbosch

www.katzabosch.com

www.katzabosch.com increases complication

Virginia tax brackets 2020. What is the virginia tax rate for 2019. Virginia income tax calculator

Posting Komentar untuk "tax rate in virginia 2022 Virginia tax income state taxes rates employment self rate"