luxury car tax threshold 2023 February '23 business round-up

Okay, okay, okay. So you're thinking about getting a fancy new ride, huh? Well, have I got some news for you! Turns out, the government is offering a sweet exemption for electric cars. And, as if that wasn't enough, the luxury car tax threshold has changed to help you save some dough. Buckle up, baby, we're about to get into it.

FBT Exemption on Electric Cars

Now, I know what you're thinking. "Electric cars? They don't have enough vroom-vroom for my taste." But hear me out. Not only will you be saving on fuel costs, but now you can save on your FBT (Fringe Benefit Tax) too! That's right, if you're driving an electric car for work purposes, you are now exempt from paying FBT. That's what I like to call a double win. Just make sure you keep your receipts and logbook up to date.

And, let's be honest, electric cars have come a long way from those dorky looking golf carts. They've got all the bells and whistles you could want, plus they're better for the environment. It's a win-win! So, why not give it a try?

Explained: ATO Luxury Car Tax Changes for 2022-2023

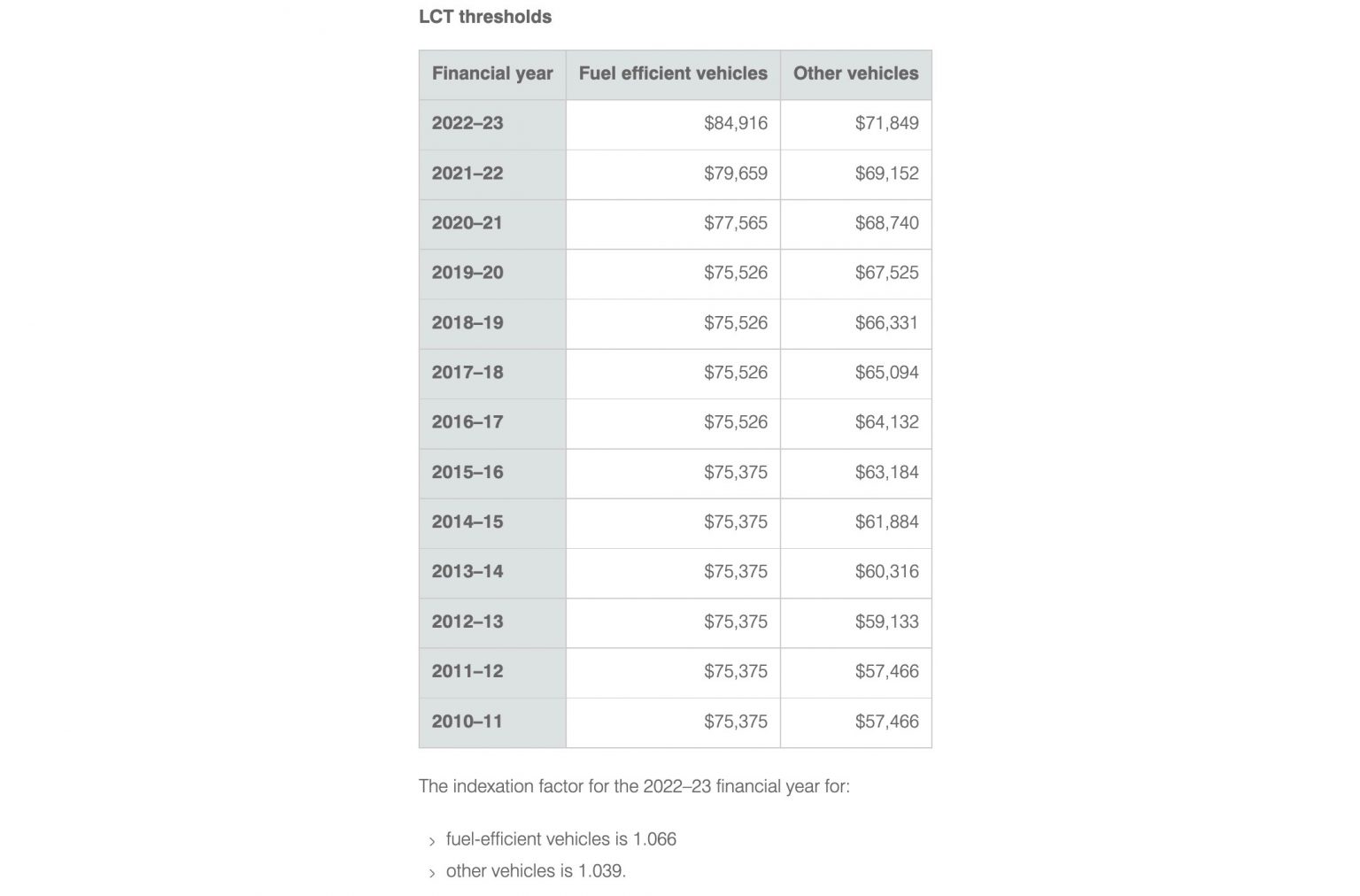

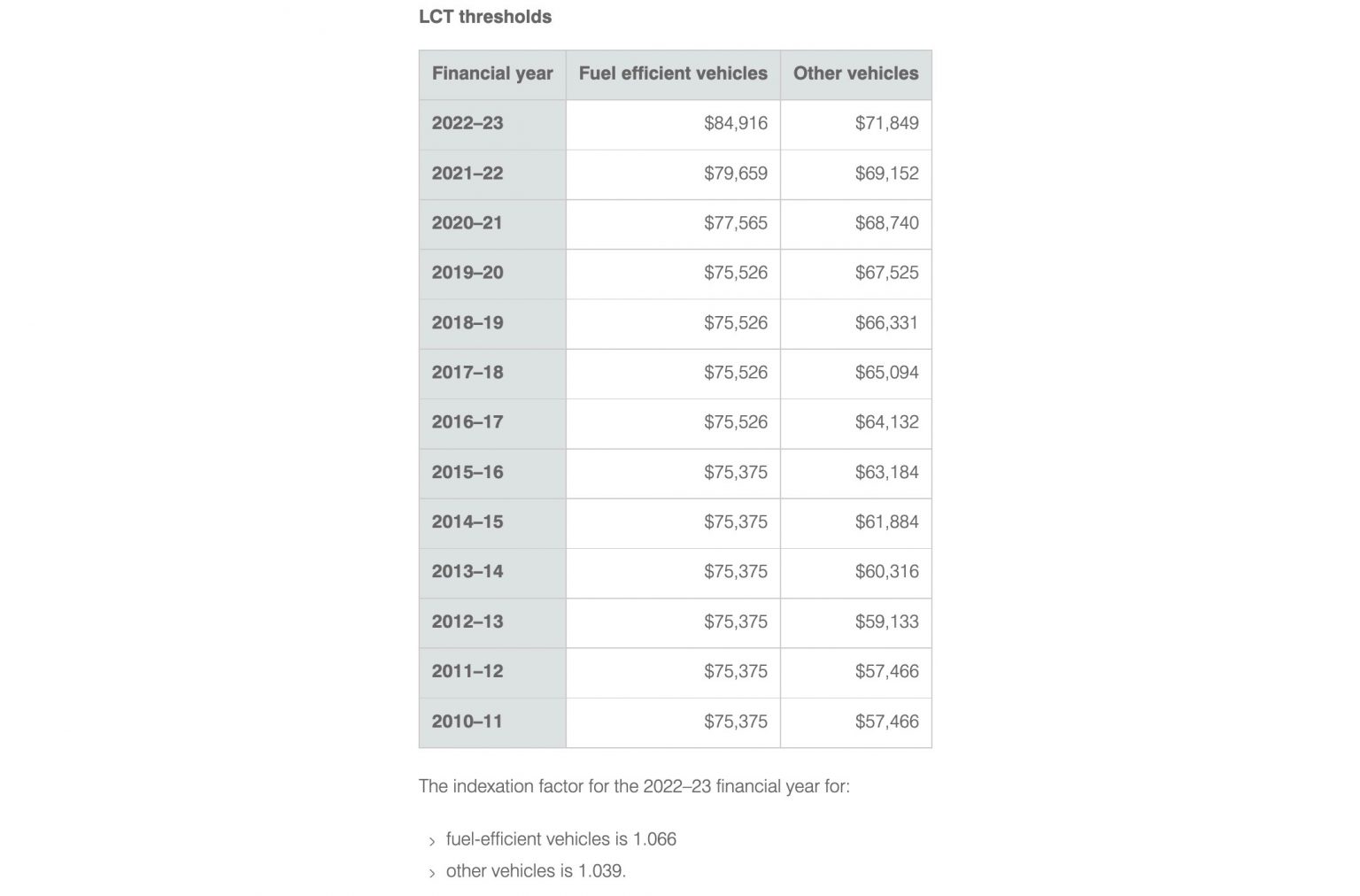

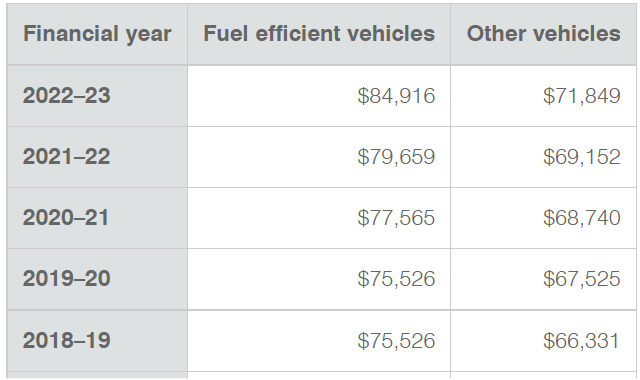

Now, if you're more of a luxury car fan (no judgement here), you're in luck too. The ATO (Australian Taxation Office) has changed the luxury car tax threshold. What does that mean for you? Well, it means that you can now save some money on those fancy wheels you've been eyeing.

Basically, the ATO has increased the luxury car tax threshold to $69,152 for fuel-efficient vehicles and $77,565 for all other vehicles. That means if your car costs less than that amount, you won't have to pay the extra tax. It's like Christmas came early!

Recipe for Success

Now, I know this all sounds too good to be true. But it's not! So, if you're ready to take the plunge, here's what you need to do:

Ingredients:

- Electric car or luxury car under the new threshold

- Receipts and logbook (for electric car exemption)

Instructions:

- Choose the electric car or luxury car of your dreams.

- If choosing an electric car for work purposes, keep your receipts and logbook up to date to claim the FBT exemption.

- If choosing a luxury car, make sure it falls under the new ATO luxury car tax threshold to save some extra cash.

- Enjoy your new ride and all the money you'll save!

See, it's easy as pie (or should I say cake). So, what are you waiting for? It's time to rev up those engines and hit the road. Happy driving!

If you are looking for Explained: ATO Luxury Car Tax changes for 2022-2023 in Australia you've visit to the right page. We have 5 Pics about Explained: ATO Luxury Car Tax changes for 2022-2023 in Australia like Explained: ATO Luxury Car Tax changes for 2022-2023 in Australia, 2023 Ineos Grenadier sidesteps Luxury Car Tax in landmark ruling and also February '23 Business Round-Up. Here it is:

Explained: ATO Luxury Car Tax Changes For 2022-2023 In Australia

performancedrive.com.au

performancedrive.com.au FBT Exemption On Electric Cars - Quantiphy

quantiphy.com.au

quantiphy.com.au February '23 Business Round-Up

www.linkedin.com

www.linkedin.com When To Buy An EV - Updated 15 08 2022 - Julia's Blog

bantacs.com.au

bantacs.com.au 2023 Ineos Grenadier Sidesteps Luxury Car Tax In Landmark Ruling

www.drive.com.au

www.drive.com.au Explained: ato luxury car tax changes for 2022-2023 in australia. Fbt exemption on electric cars. 2023 ineos grenadier sidesteps luxury car tax in landmark ruling

Posting Komentar untuk "luxury car tax threshold 2023 February '23 business round-up"