how much is connecticut sales tax How much does connecticut rely on income tax? compared to most states

Are you planning a trip to Connecticut and wondering about the sales tax rate? We’ve got you covered! Connecticut’s sales tax rate is currently 6.35%. It’s important to keep this in mind when budgeting for your trip, as sales tax will be added to most purchases you make while in the state.

What is Sales Tax?

Sales tax is a tax on retail purchases. It’s added to the price of items and is paid by the consumer at the time of purchase. The revenue generated from sales tax goes towards funding state and local government programs and services.

Connecticut’s Sales Tax Rate

As mentioned earlier, Connecticut’s sales tax rate is 6.35%. This is a standard rate that applies to most purchases made in the state. However, there are a few exceptions to this standard rate:

- Admission and Amusement Tax: This is an additional tax of 10% that is added to the price of admission to certain events and attractions.

- Lodging Tax: This is an additional tax of 15% that is added to the price of lodging accommodations such as hotels and motels.

- Prepared Food and Beverage Tax: This is an additional tax of 7.35% that is added to the price of prepared food and beverages sold in restaurants and other establishments.

Why Sales Tax is Important

Sales tax is a necessary part of funding our state and local governments. Without it, these programs and services would not be able to function. Sales tax revenue is used to fund everything from education and healthcare to road maintenance and public safety.

Tips for Managing Sales Tax

When budgeting for your Connecticut trip, remember to include sales tax in your calculations. To help you manage your sales tax expenses, here are a few tips:

- Keep Receipts: It’s always a good idea to keep receipts for all of your purchases. This will help you keep track of your spending and make sure you’re not overcharged.

- Know the Exemptions: There are some items that are exempt from sales tax in Connecticut, such as clothing and certain types of food. Make sure you know what is exempt and what is not to avoid unnecessary expenses.

- Shop Around: Not all retailers charge the same amount of sales tax, so it’s a good idea to shop around for the best deals. You may be able to save money by finding a retailer with a lower sales tax rate.

Conclusion

Now that you know all about Connecticut’s sales tax rate, you can plan your trip with confidence. Remember to budget for sales tax and keep these tips in mind to make the most of your money. Happy travels!

Image Sources:

Image 1:

Image 2:

Recipe:

Ingredients:

- 1 pound ground beef

- 1 onion, chopped

- 1 green bell pepper, chopped

- 2 cloves garlic, minced

- 1 can (14.5 oz.) diced tomatoes

- 1 can (15 oz.) kidney beans, drained and rinsed

- 1 package (1.25 oz.) chili seasoning mix

- Salt and pepper to taste

Instructions:

- In a large skillet or Dutch oven, cook the ground beef, onion, green pepper, and garlic over medium heat until the beef is no longer pink and the vegetables are tender.

- Add the diced tomatoes, kidney beans, chili seasoning mix, salt, and pepper. Stir to combine.

- Cover and simmer for 20-30 minutes, stirring occasionally.

- Enjoy!

If you are searching about How Much Does Connecticut Rely On Income Tax? Compared To Most States you've came to the right web. We have 5 Pics about How Much Does Connecticut Rely On Income Tax? Compared To Most States like Connecticut has 2nd highest tax collection rate in the country | Yankee, Connecticut Printable 6.35% Sales Tax Table and also How Much Does Connecticut Rely On Income Tax? Compared To Most States. Here it is:

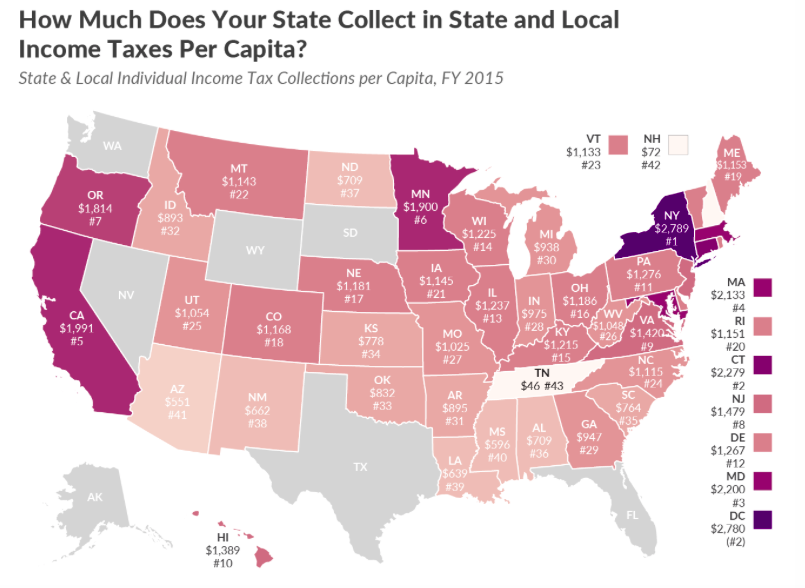

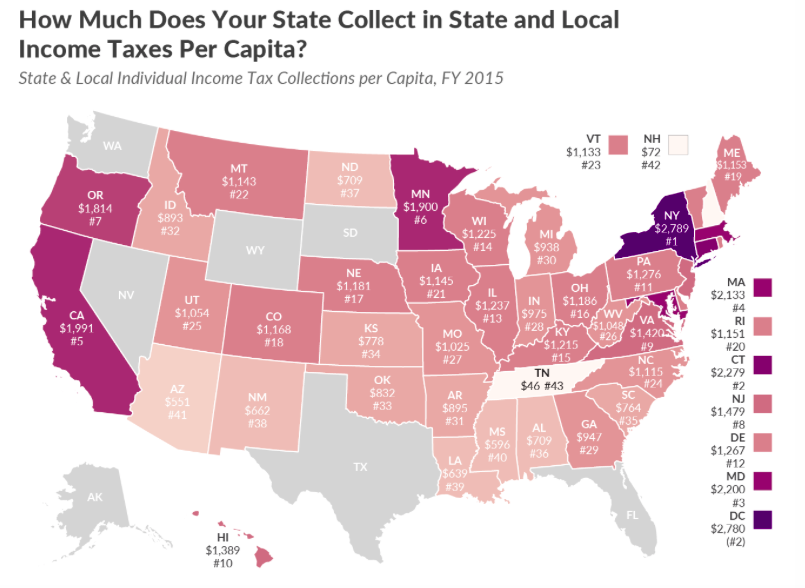

How Much Does Connecticut Rely On Income Tax? Compared To Most States

connecticut income courant compared rely tax states much does lot most

Connecticut Has 2nd Highest Tax Collection Rate In The Country | Yankee

yankeeinstitute.org

yankeeinstitute.org connecticut tax collection rate country state highest 2nd taxes income per placed ranking foundation annual based second states local

Connecticut Sales Tax Filing Frequency

frequency quarterly

Connecticut Printable 6.35% Sales Tax Table

www.sales-taxes.com

www.sales-taxes.com state

Discover All You Need To Know About The Connecticut Sales Tax Rate

foreignusa.com

foreignusa.com tax sales rate connecticut illinois alabama colorado abbreviation state rates

Connecticut sales tax filing frequency. Discover all you need to know about the connecticut sales tax rate. Connecticut has 2nd highest tax collection rate in the country

Posting Komentar untuk "how much is connecticut sales tax How much does connecticut rely on income tax? compared to most states"