west virginia fuel tax Alternative fuel: wv alternative fuel tax credit 2012

Driving down the roads of West Virginia just got a little cheaper thanks to a fuel tax cut that went into effect in 2017. That means more money in our pockets to spend on the things that we love. But what if I told you that there was a way to save even more money on fuel? And no, it doesn't involve using a time machine to go back to 2017 and purchase a new car. It's all about alternative fuels. Not only are they better for the environment, but they can also save us money in the long run. And in West Virginia, we even have a tax credit for using them. So what exactly qualifies as an alternative fuel? Well, it could be anything from electricity to propane to natural gas. Basically, anything that isn't traditional gasoline or diesel. And the great thing is that many of these alternative fuels are becoming more widely available, making them a real option for everyday drivers like you and me. But why should we care about using alternative fuels? For starters, they're cleaner burning than traditional fuels, meaning they produce less harmful emissions. That's good news for both the environment and our health. But perhaps even more importantly, alternative fuels also tend to be cheaper than gasoline and diesel. And with the West Virginia alternative fuel tax credit, using them can save us even more money. So how do we take advantage of this tax credit? First, we need to make sure that our vehicle qualifies. This can include things like electric vehicles, hybrid vehicles, and vehicles that run on propane or natural gas. Next, we need to make sure that we're using the alternative fuel for personal transportation purposes, meaning it can't be used for commercial purposes. Once we meet those requirements, we can claim a tax credit of up to 50% of the cost of converting our vehicle to an alternative fuel, up to a maximum of $7,500. And if we're using a plug-in electric vehicle, we can also claim an additional tax credit of up to $7,500. That's a lot of savings! But it's not just about the tax credit. Using alternative fuels also means that we're doing our part to reduce our carbon footprint and take care of the planet for future generations. So what are you waiting for? Let's start exploring alternative fuels and see how much money we can save while making a positive impact on the environment.  wvmetronews.com

wvmetronews.com  alternativefueljiagemo.blogspot.com

alternativefueljiagemo.blogspot.com  www.formsbank.com

www.formsbank.com  wchstv.com

wchstv.com

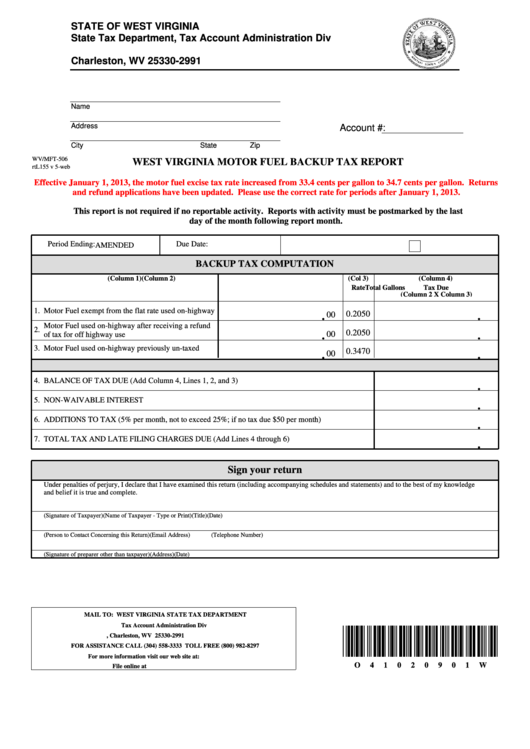

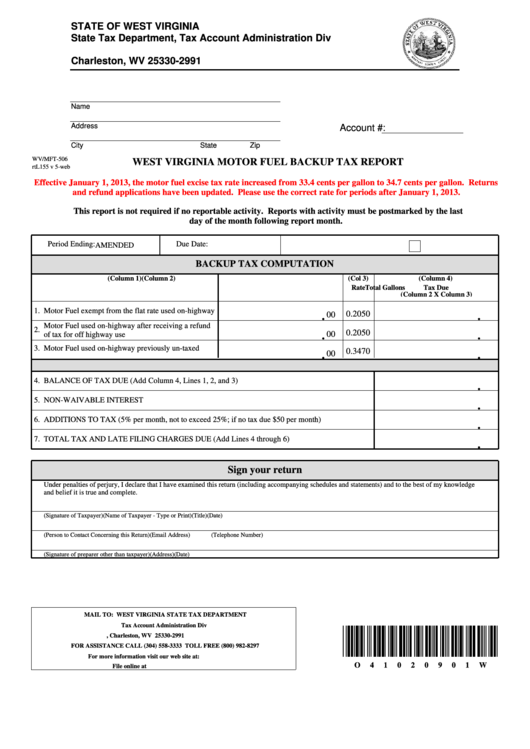

If you are searching about West Virginia fuel tax drops on New Year's, but is it cause to you've visit to the right web. We have 5 Images about West Virginia fuel tax drops on New Year's, but is it cause to like West Virginia fuel tax drops on New Year's, but is it cause to, West Virginia fuel tax drops on New Year's, but is it cause to and also Fillable Form Wv/mft-506 - West Virginia Motor Fuel Backup Tax Report. Read more:

West Virginia Fuel Tax Drops On New Year's, But Is It Cause To

West Virginia Fuel Tax Drops On New Year's, But Is It Cause To

wvmetronews.com

wvmetronews.com Alternative Fuel: Wv Alternative Fuel Tax Credit 2012

Fillable Form Wv/mft-506 - West Virginia Motor Fuel Backup Tax Report

www.formsbank.com

www.formsbank.com tax wv motor virginia west fuel form report backup mft printable pdf

West Virginia Fuel Tax To Decrease In 2017 | WCHS

wchstv.com

wchstv.com West virginia fuel tax to decrease in 2017. West virginia fuel tax drops on new year's, but is it cause to. Metronews wvmetronews downward trended

Posting Komentar untuk "west virginia fuel tax Alternative fuel: wv alternative fuel tax credit 2012"