ato luxury car depreciation limit 2022 Car tax limits 2020/21

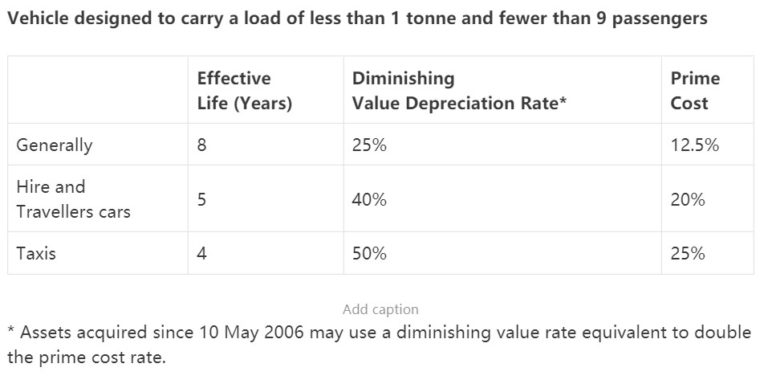

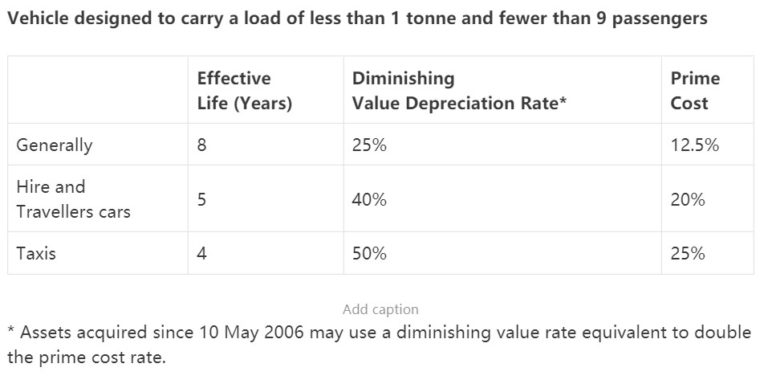

Starting with the new updates on car cost depreciation limits, there have been significant changes made for the fiscal year 2020-21. As per the latest MTA Queensland report, the car depreciation limit has increased, and it is an excellent opportunity for individuals who own a car that is used for business purposes. The limit has increased from $57,581 to $59,136 for the cars purchased and put to use after June 30, 2019. It is essential to understand that this limit is inclusive of GST, and it might affect the claimable amount on luxury car tax. As per the Australian Taxation Office (ATO), car depreciation can be claimed through two methods: Prime Cost and Diminishing Value. The Prime cost method is used when the decline in value is uniform over the period of use. While on the other hand, the Diminishing Value method is used as the car value decreases exponentially over time. When it comes to luxury cars, the ATO has a cap on the depreciation claimable, known as the luxury car limit. In most cases, the luxury car limit is $57,581 for the fiscal year 2019-20, and it will be $59,136 from this financial year onwards. It is essential to note that the luxury car limit applies to the depreciation amount and not the sale price. Moreover, individuals must keep in mind that different rules apply when the car is used for business vs. personal use. Therefore, it is always advisable to consult a professional tax consultant before making any claims. Apart from depreciation, there are other expenses that individuals incur while using their cars for business. These can include fuel costs, repairs, and maintenance expenses. It is crucial to keep track of all such expenses to claim them effectively while filing the annual tax return. In conclusion, the increased car cost depreciation limit is a welcoming change, and it can prove to be beneficial for individuals using their car for business purposes. However, it is essential to understand the rules and regulations related to car depreciation and claimable expenses to avoid any discrepancies. Seeking professional advice from a tax consultant can be an added advantage to individuals looking to make the most of their claims.  yareli-has-barton.blogspot.com

yareli-has-barton.blogspot.com  www.creditlinkaustralia.com.au

www.creditlinkaustralia.com.au  www.mtaq.com.au

www.mtaq.com.au  gapaccountants.com.au

gapaccountants.com.au  atotaxrates.info

atotaxrates.info

If you are looking for Ato Luxury Car Limit - Yareli-has-Barton you've came to the right page. We have 5 Pictures about Ato Luxury Car Limit - Yareli-has-Barton like Depreciation of Vehicles - atotaxrates.info, Ato Luxury Car Limit - Yareli-has-Barton and also Depreciation of Vehicles - atotaxrates.info. Here it is:

Ato Luxury Car Limit - Yareli-has-Barton

Car Tax Limits 2020/21

www.creditlinkaustralia.com.au

www.creditlinkaustralia.com.au car limits tax

Car Cost Depreciation Limit Increased For 2020-21 | MTA Queensland

www.mtaq.com.au

www.mtaq.com.au hilux rocco revo 4x4 truck cabine dubbele strada landweg nieuwe asfalt doppia camioncino fuori carrozza della bangkok depreciation limit

Luxury Car Tax Thresholds - GAP Accountants

gapaccountants.com.au

gapaccountants.com.au tax thresholds lct

Depreciation Of Vehicles - Atotaxrates.info

atotaxrates.info

atotaxrates.info depreciation comparativo income posmodernos filosofos ato

Depreciation of vehicles. Ato luxury car limit. Car cost depreciation limit increased for 2020-21

Posting Komentar untuk "ato luxury car depreciation limit 2022 Car tax limits 2020/21"